:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

The W-4 form makes it easy to adjust your withholding to account for certain tax credits and deductions. It's Easy to Account for Tax Credits and Deductions

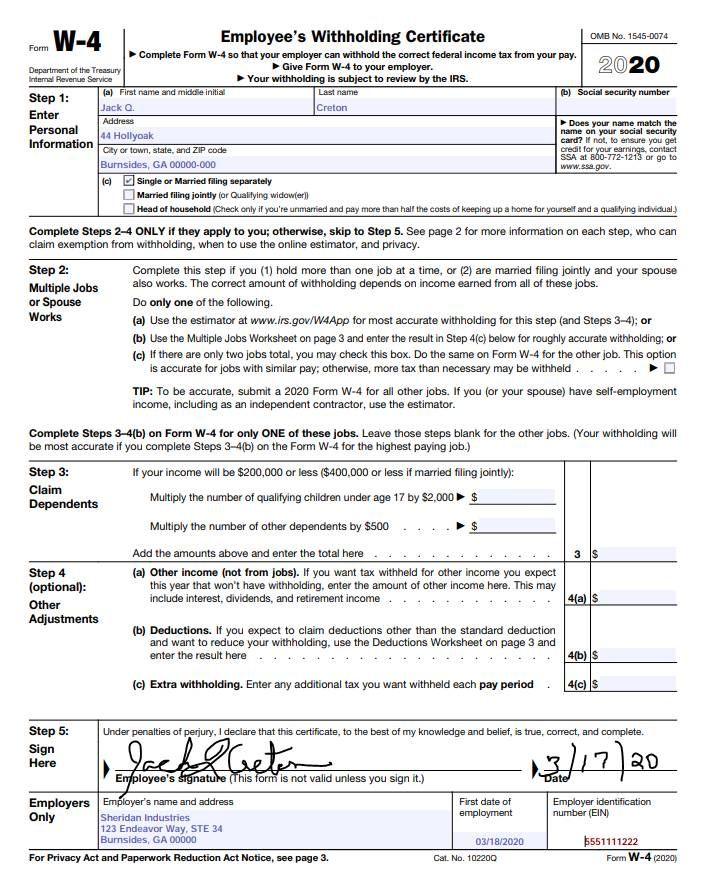

(By accurate, they mean having total withholding as close to your expected tax liability as possible.) Also note that the IRS recommends completing a W-4 for all your jobs to get the most accurate withholding. Step 2 of the form actually lists three different options you can choose from to make the necessary adjustments. Therefore, adjustments to your withholding must be made to avoid owing additional tax, and maybe penalties, when you file your tax return.įortunately, the W-4 form has a section where you can provide information about additional jobs and working spouses so that your withholding can be adjusted accordingly. As a result, if you have more than one job at a time or file a joint return with a working spouse, more money should usually be withheld from the combined pay for all the jobs than would be withheld if each job was considered by itself. Tax rates increase as income rises, and only one standard deduction can be claimed on each tax return, regardless of the number of jobs. Having multiple jobs or a spouse who works can affect the amount of tax withheld from your wages. Multiple Jobs and Working Spouses Require More Information You'll probably have to take the form home and fill it out there, instead of turning it in right away on your first day of work. "Nobody remembers that off the top of their head," he notes, "so it could be time consuming" collecting the necessary information. They'll need to know what their total deductions were last year, if they still qualify for the child tax credit, how much non-wage income they reported on their last return, and similar tax-related things. When new hires are handed a W-4, "they may need to call their accountant to ask questions, or have their spouse look up information from their last tax return," says Pete Isberg, Vice President of Government Affairs for payroll processor ADP.

That's because you'll have to dig up information about your spouse's income, your dependents, tax credits, and the deductions you expect to claim. If your taxes are more complicated, it will probably take you more time to complete a W-4 form. The W-4 Form Takes Longer if Your Taxes are Complex This is especially important if you have a major change in your life, such as getting married, having a child, or buying a home. If your tax withholding is off kilter, go ahead and submit a new W-4 as soon as possible. (Remember, a large refund just means you gave the IRS an interest-free loan.) We recommend an annual check using the IRS's Tax Withholding Estimator (opens in new tab) to make sure you're on track as far as your withholding goes (the earlier in the year the better). Ideally, you want your annual withholding and your tax liability for the year to be close, so that you don't owe a lot or get back a lot when you file your return. You'll also have to file a new W-4 form if you want to adjust the amount of tax your current employer withholds from your paycheck. That's the only way your new employer will know how much federal income tax to withhold from your wages. However, if you start a new job, you'll have to complete a W-4 form at that time. You're not required to periodically submit a new W-4 form.

If you're happy with your current tax withholding, then do nothing and leave your current Form W-4 in effect with your employer. Workers aren't required to file a W-4 form with their employer every year - but you might want to anyway. Workers Don't Need to Submit a W-4 Form Every Year

0 kommentar(er)

0 kommentar(er)